Ian A. Maxwell is a veteran Technology Entrepreneur and Venture Capitalist. He is currently CEO ofBT Imaging, Chair of Instrument Works and Co-Founder of Accordia IP as well as a partner at Zetta Research and an Adjunct Professor at RMIT. He has a PhD in Chemistry and has either founded or worked at Memtec, Allen & Buckeridge, Redfern Photonics, Sydney University Polymer Centre, James Hardie, Viva Blu, Enikos, Wriota, RPO and Instrument Works. You can connect with him on Linkedin au.linkedin.com/in/maxwellian

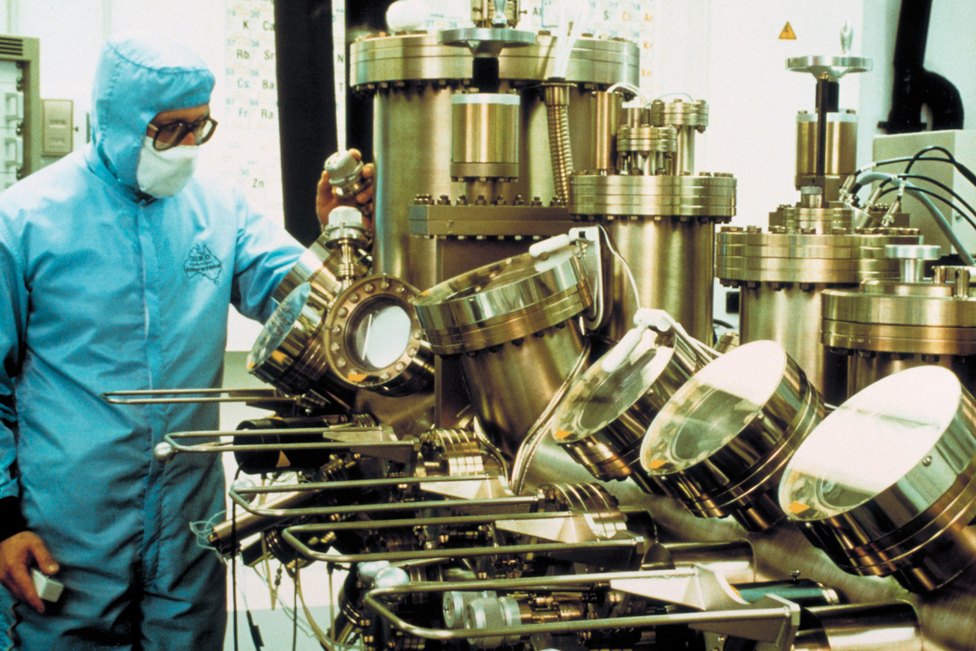

CSIRO is Australia’s Federally funded Commonwealth Scientific and Industrial Research Organisation which was founded in 1926 and employs 5000 people across more than 50 establishments.

“I’d wind back government-funded research in a heartbeat; it’s hard to justify in a climate of big deficits.” Federal Senator, David Leyonhjelm.

Larry Marshall is an old colleague from the world of start-ups and venture capital. Along with others that know Larry and have had dealings with CSIRO , I was quite surprised late last year when Larry was announced as the new CEO of CSIRO. However, not unpleasantly surprised.

Larry Marshall

CSIRO has a history of unusual CEO appointments. By way example let’s have a look at the three prior appointments; Megan Clark had previously been the Vice President, Health, Safety, Environment, Community and Sustainability at BHP; Geoff Garrett was head of the South African CSIR, the South African equivalent to CSIRO; and Colin Adam had been the head of commercialisation in CSIRO prior to becoming CEO but before that had been out in the corporate sector.

These are ‘unusual’ appointments because none are internal appointments of candidates with long term history within CSIRO. An organization which is performing strongly tends to have processes to identify and groom internal CEO candidates. Often a candidate that does become CEO has been employed in the organization for decades, in many different roles. Some current well-known examples would be Tim Cook of Apple who has been there since 1998, and Jeffrey Immelt of GE who has been at the company since 1982. These internal CEO candidates carry the culture and vision of the organisation with them into their CEO roles in a way that an external candidates cannot. The very choice of an external CEO candidate is often a tacit recognition that the organisation needs a new culture and vision.

CSRIO Headquarters

From an outsider’s perspective it appears that CSIRO has struggled to find relevance after the deregulation of the Australian economy in the 1980s and the subsequent changes therein. Since this period there has been a dramatic shift in our economy towards the (science-agnostic) services sector which now generates 68% of our GDP. CSIRO, with its primary focus on science, is primarily left serving the resources and agricultural sectors, plus some other sectors at the fringes of economic importance in Australia.

Another change that we saw in the late 1980s was the deregulation of the Australian university sector which led to these organisations becoming willing and able to work with the Australian private sector. Before this they had, for various reasons, been less interested in doing so. In fact, the federal government, through the Linkage grant scheme, the CRC program and other schemes, actively encouraged university and ‘industry’ engagement. The expanding university sector effectively began to compete with CSIRO in what was a shrinking market for outsourced scientific services in Australia.

Any perusal of the CSIRO website, or any article written by CSIRO strategists, quickly reveals that CSIRO sees itself as a purveyor of scientific services and science-derived outcomes. That is, the ‘S’ and ‘R’ in CSIRO dominate their thinking. For example, at the CSIRO website the ‘about us’ by-line reads ‘At CSIRO we shape the future. We do this by using science to solve real issues.’

This focus on science is at a time when the global high-growth technology business sectors (in which Australia is seriously lagging) are increasingly being driven by engineering and IT technologies, and less so by science. With CSIRO’s focus on ‘scientific services and outcomes’ in Australia their TAM (total available market) is even further reduced compared to a scenario in which they also had a serious focus on IT and engineering.

Little wonder that with a reliance on over three quarter of a billion dollars in federal funding per annum that the CSIRO leadership has been desperate to find a role that is either more profitable or at least generates enough positive publicity such that government funding is secure. However, despite over two decades of restructuring and unusual CEO appointments, it could be plausibly argued that the organization is no closer to finding a secure place in the Australian economy.

CSRIO Research Ship “The Franklin”

The organisation has had decades of constant organizational restructures, a matrix management structure that few believe in, and an oversupply of ‘managerialism’ emanating from head office. Recent cuts have culled $111m off the CSIRO budget over four years and resulted in the loss of around 700 jobs. In 1996, CSIRO employed 7,400 people, and by 2015 the number is closer to 5,000.

CSIRO, rather confusingly, variably focuses on nine National Flagships, Science Excellence and Preparedness, Deep Collaboration and Connection, being an Innovation Organisation and a Trusted Advisor. CSIRO also operates three lines of business; the ‘National Facilities and Collections’, CSIRO services, and the aforementioned nine National Flagships, which are Agriculture, Biosecurity, Digital Productivity, Energy, Food and Nutrition, Land and Water, Manufacturing, Mineral Resources, and Oceans and Atmosphere. It is arguable whether all of these activities are world class, but more importantly it is also arguable whether a local capability deep in the science of all these areas has relevance to Australia in 2015.

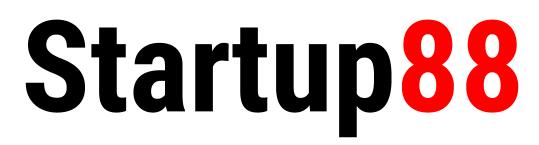

Repurposing Science

It is worthwhile considering what happens when the management of CSIRO announced these nine Flagships for the very first time. Every scientist in the organisation simply chose which Flagship they were in, or the choice was made for them or against them. However, scientists cannot simply adopt a new discipline at the drop of a hat; whatever choices were made they remained as chemists, physicists or mathematicians with a primary focus in a very specific sub-field within their discipline. In the modern era it takes a scientist decades to build up a portfolio of publications and a reputation within a specific and tight field of activity. It can be very inconvenient to have an employer like CSIRO suggest to the chemist that she abandons, say, a life-long focus on a specific new type of radical chemistry where she is a world expert, in order to chase some unrelated agricultural chemistry challenge that will likely be a victim of the next restructure.

CSRIO Solar Array

The point I am making is that an organisation with science as its primary focus is the single most unlikely candidate for successful repurposing. Efforts to do so, as have been seen at CSIRO since the 1980s, just make the scientists unnecessarily stressed and sometimes also passively uncooperative, and as a result the organisation is even less likely to be successful in an innovative or entrepreneurial sense.

The New CEO

Enter Dr Larry R. Marshall. Larry is a serial entrepreneur credited with many successful start-ups in areas as diverse as biotechnology, photonics, & semiconductors. Some of these companies have been successfully sold to larger operating companies and one went onto an Initial Public Offering. Larry has also been a venture capitalist and a private investor. He has had significant business dealings in China and the USA, and in both countries he is extraordinarily well connected to leaders in the tech sectors. He is a serial inventor named on around 20 patent families and has somehow managed to find the time to be an author on over 100 research publications. This is a non-trivial set of polymath achievements, quite rare in its breadth and depth. However, none of it speaks directly to the skills needed to turn around a large and unprofitable organization that is in need of something dramatic just to survive.

CSIRO generally has five year plans and they are due for a new one right now. I suspect that this federal government, or any federal government, would like to define success for CSIRO as zero federal funding requirements. I find it quite remarkable that CSIRO already attracts about one third of its operating costs from commercial activities; they should be applauded for this achievement. However, given the size of the market for ‘scientific services and outcomes’ in Australia I would suggest that any attempts to grow this market with today’s pricing structure may be up against the Pareto rule, i.e. the cost of acquiring new customers will become higher and higher, to the point of unprofitability, as their market share becomes even more dominant.

In this context, and assuming continued pressure on their public funding, CSIRO has two stark options; to reduce in size, commensurate with their genuine market revenues, or to find entirely new sources of revenues.

Looking at Larry’s entrepreneurial background it’s not rocket science to suggest that he would rather attempt to achieve great success at CSIRO as opposed to overseeing a transition to a much smaller and more secure scientific services provider.

Larry himself has signalled that the sources of new revenue might be involve a more entrepreneurial focus; “… I can’t promise that change is now over … We’ve got to focus our efforts … We’ve got to be more entrepreneurial and agile … We’ve got to get our overheads down … we’ve got to create some more headroom for exploration … I have learned a lot about lean innovation and focussing on where we are unique”

It was in this context that Larry and I shared a beer in mid-March of this year. He told me that he is still in the process of formulating his thinking on his role as CEO of CSIRO. His big priority is to oversee the new five year strategic plan that is due by June this year. Rather than report on our discussion, which would be a little unfair to Larry given the early stage of his engagement, this article has become more of an opinion piece, as you may have noticed.

Assuming that CSIRO will maintain its current services activities and in addition adopt a more entrepreneurial focus, here is my input into the process of developing a strategy around this.

The People

Very few scientists are innovators; this is because scientists often have an opposing personality type to innovators, and in Australia our tertiary education and research system seems to make sure of that distinction by almost completely failing to offer any rewards for scientists that are also innovators. I would also note that some of the most successful innovators are bower-birds; they aggregate and morph the ideas of others – a concept that might be quite against the ‘ethical’ code of many scientists.

Innovation and entrepreneurship are rarely skills possessed by a single person. For example, I have seen many start-ups where the core concepts are provided by a very innovative technology founder who had zero entrepreneurial skills. And then the investors inevitably parachute in a high quality entrepreneur who couldn’t innovate his or her way out of a brown paper bag. All an entrepreneur needs to be able to do is recognise the innovation of others. In fact, it’s probably better that entrepreneurs don’t innovate themselves because we all unduly weight the importance of our own ideas.

Innovation and entrepreneurship are rarely skills possessed by a single person. For example, I have seen many start-ups where the core concepts are provided by a very innovative technology founder who had zero entrepreneurial skills. And then the investors inevitably parachute in a high quality entrepreneur who couldn’t innovate his or her way out of a brown paper bag. All an entrepreneur needs to be able to do is recognise the innovation of others. In fact, it’s probably better that entrepreneurs don’t innovate themselves because we all unduly weight the importance of our own ideas.

In this context, if CSIRO has thousands of scientists it is very likely that they are short of three things; innovators, entrepreneurs and risk-happy investors that will follow the innovators and entrepreneurs. So the challenge for Larry is how to attract these three elements to the organization. One thing is for sure, if one was going to create a large national innovation centre, in the ideal world one would not start from where CSIRO is today.

The question as to whether CSIRO is a source of innovation or a source of technical skills is paramount. CSIRO has spent a small fortune on advertising its rare commercial outcomes and may be trapped in the thinking that it can be a viable source of innovative concepts. I have said it before, it is far more cost effective for an organization to simply borrow or buy innovative concepts from elsewhere and make these successful. The only logical reason why an organisation would solely promote investment in its own concepts is pride.

A proposed merger between CSIRO and NICTA could arguably bring in much need ITC skills into CSIRO. However NICTA is also somewhat afflicted by its roots in academia when it comes to innovation and entrepreneurship. In this context it’s actually quite hard to guess whether the presence of NICTA would help or hinder CSIRO. What NICTA’s short history does highlight though is the challenges ahead for CSIRO. NICTA, a cleansheet organization in 2003, has valiantly struggled to escape from the entitlement vice of academic researchers but they can’t reasonably claim success in these endeavours.

The Focus of Activities

Anyone that has used CSIRO’s scientific services can attest to their relatively high costs compared to equivalent services offered by universities or third party research providers. The primary cause of these high costs can be attributed to the (arguably) bloated head office which adds a high burden of overhead on all pricing as well as what can only be described as an incredible self-belief in the high value of the services that are being offered, which seems to further inflate prices. I have often wondered as to the elasticity of the market for scientific services in Australia; for example, at half the price is the market five times as big? My gut feeling is that CSIRO over-prices its services and the best way to address this is to create a very small footprint at head office with minimal influence over the operating groups.

As stated above CSIRO’s current nine focus areas are somewhat artificial. Within the organisations there are groups that pay their own way by providing scientific services and then there are others that provide public good outcomes that are so valuable that they obviously should be supported. For the rest, they will need to show how their efforts and skills can be part of a program to support innovation with demonstrable commercial outcomes. In order to achieve this they will need to engage with third parties such as innovators, entrepreneurs and investors in technology. This is a new paradigm for the CSIRO staff and the organisation (a reformatted one) will need to lead them very gently on the journey.

SMEs within the dominant services sector in Australia rarely have formal innovation processes or R&D budgets. Positive changes to their services and prices typically result from their front-line people working with their technology vendors to provide innovation. In a practical sense, the biggest commercial opportunity for CSIRO in Australia is with the SMEs in the services sector. The challenge of course is to find the relevance of science to SMEs in the service sector; the alternative for CSIRO is to become more driven by IT and engineering. The less attractive alternatives would be the oligarchical big-end of the ASX, the virtually defunct Australian venture capital sector, or the garagistas of the IT incubator world.

Stakeholders

The office of Australia’s Chief Scientist appears to be a lobby group for the university sector which should be viewed as direct competition to CSIRO for both market share of scientific services and public funding. Personally I do not believe this situation is in Australia’s best interest and my personal opinion is that Australia needs a Chief Technologist that is not a former Vice Chancellor nor a former head of R&D for a resources company or any large ASX entity, but is in fact someone like Larry Marshall. This is the 21st century and the ITC sector is driving one of the greatest technological and social changes in human history; we would be foolish to ignore this by continuing to appoint old-guard types to such senior posts.

In the private sector, companies have a very simple metric for success and it’s called dollars. CSIRO has no such simple metric since its sole ‘shareholder’, the federal government, seems to sometimes also value other less tangible outcomes such as public good. The problem with this is that the organisation is exposed to changes in the mood in Canberra especially when budgets go into structural deficit. The challenge for CSIRO in developing a new technology-driven five-year strategy is the lack of vision in Canberra as to what a different Australia might look like. The evidence for this assertion is that the profits from the last resources boom were not substantially invested in a developing a new high-tech version of the Australian economy. Lacking a clear vision from their ‘shareholder’ CSIRO has to develop its own strategy and metrics of success in a partial vacuum.

Time is of the Essence

Whatever changes Larry Marshall is planning for CSIRO, these have to happen quickly. Time is critical and further budget cuts are very possible. CSIRO is a large single line item in the budget and that makes it very exposed.

To the employees of CSIRO I would implore you to get behind Larry.

I believe that he is exactly what you need right now and whether you accept this or not, as an organisation this may very well be one of the last chances that you have.

Images CC courtesy of CSRIO – ScienceImage