Transfer Station Philadelphia

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

While Crowdfunding gets most of its publicity due to massive campaigns for sexy devices on Kickstarter our US Crowdfunding expert David Drake says that increasingly companies like Fundrise are running projects that use Crowdfunding to fund real estate, in particular providing investors access to wholesale development deals and giving members of the community the ability to fund local community real estate projects.

ED: Funrise recently announced they have raised ~$30 million infunding from Chinese Social Networking company RenRen

Crowdfunding has now grown from a niche to a legitimate platform for funding projects of all kinds by raising money from the public at large. Nowhere has this been more pronounced than the real estate sector where there are now a number of crowdfunding platforms offering investors the chance to participate directly in real estate projects. Traditionally, the real estate market has been the exclusive preserve of wealthy and well-connected individuals with the exception of real estate investment trusts (REITs).

Leading real estate crowdfunding platform Fundrise takes a slightly different approach from other platforms because it emphasises the social benefits that arise from investors having a say in the development of their own communities.

A case in point is the Transfer Station in Philadelphia which set out to test the market and got $1.8 million committed on a target of only $500,000 to create a community-oriented co-working, retail, education and event space.

It points out that local residents have a better appreciation of their community needs and should have a say in what happens there.

Sometimes, the dominance of large investors can lead to a disconnect between fund managers and the properties in which they invest.

The process is relatively straightforward with developers listing projects on the website and investors buying shares in these projects for sums starting as low as $100. Returns to the investors come from rental income and capital appreciation when the property is sold.

Fundrise is a pioneer in offering “Regulation A” investments, which allows any investor, and not just the wealthy individuals, to invest in real estate and receive attractive returns.

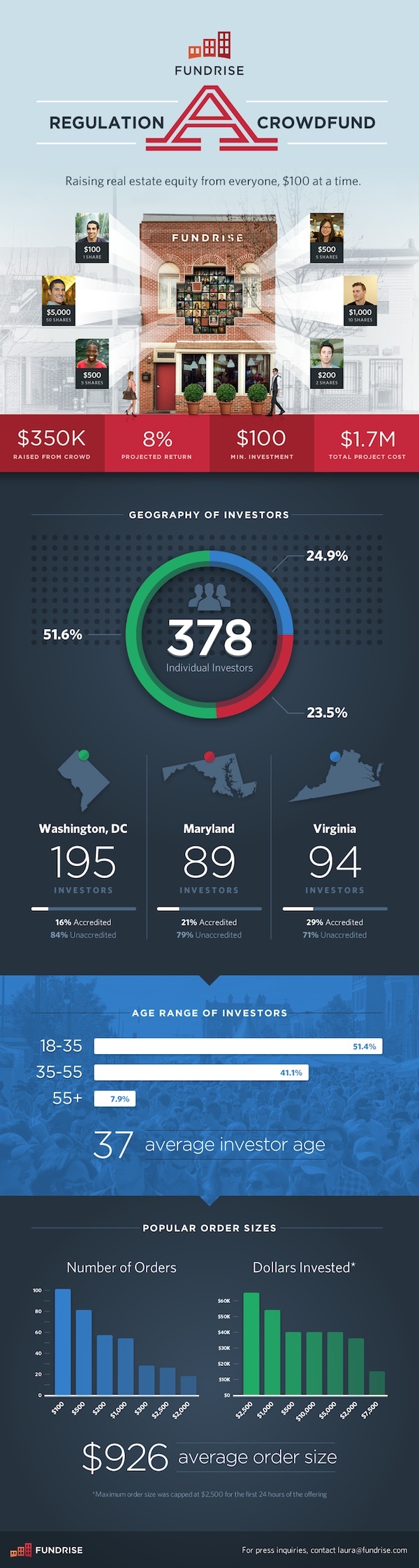

A good way of getting the flavor of how they operate is to look at the details of its recently closed third public offering, which was a property where any resident of DC, Virginia and Maryland could invest in for as little as $100 each. Fundrise ended up raising $350,000 from 378 investors, and what is interesting is that 25 percent of these investors live within a distance of 1 mile from the property.

The total project cost was $1.7 million with a projected return of 8 percent. Of the 378 investors, 51.6 percent (195) came from Washington DC of whom 16 percent were accredited investors; 24.9 percent (94) from Virginia of whom 29 percent were accredited investors; and 23.5 percent (89) from Maryland of whom 21 percent were accredited investors. Of the total investors, 51.4 percent were between the ages of 18 to 35 years, 41.1 percent between 35 years and 55 years and the remaining 7.9 percent were over 55 years old. The average age of an investor is 37 years.

The maximum number of orders was 100 for $100 apiece, followed by 80 orders for $500 each. The average order size was $926.

The numbers and the structuring may vary from transaction to transaction but this is a good representation of the investment trend on Fundrise. All their offerings have been fully funded. There is clearly considerable demand for small value investments as well as a reasonable amount of demand from investors who live in the neighbourhood.

When you tie in the fact that investors are comfortable with real estate and that diversification can be easily achieved with multiple investments in different properties in the Fundrise portfolio, the value of crowdfunding as a legitimate and credible means of funding real estate projects is clearly established. This model is certainly one template for structuring real estate crowdfunding in the future.

David Drake is an early-stage equity expert and the founder and chairman of LDJ Capital, a New York City-based family office, and The Soho Loft Media Group, a global financial media company with divisions in Corporate Communications, Publishing and Conferences.

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job