Finova Financial

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

| Startup Name | Finova Financial – 500 StartUps Batch 16 |

|---|---|

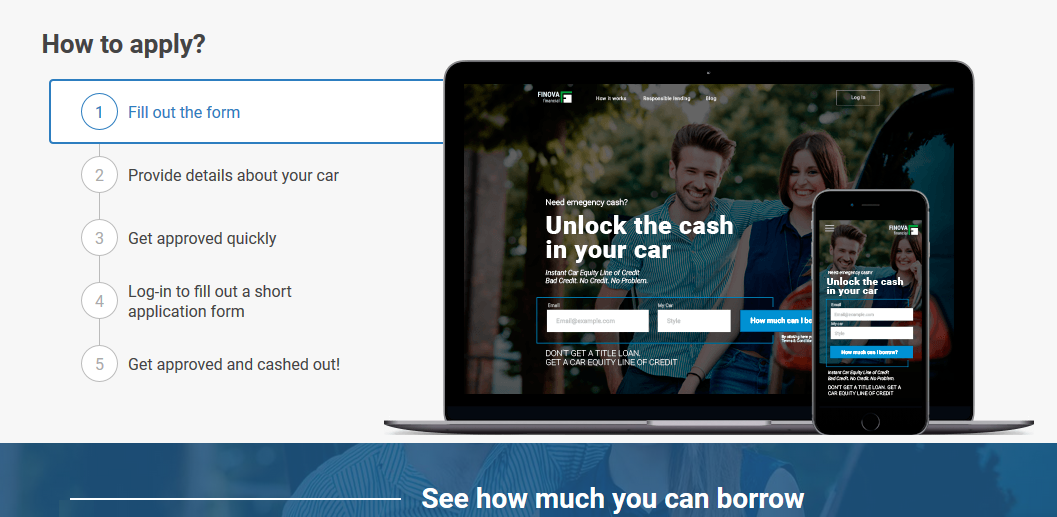

| What problem are you solving? | Finova Financial loans are designed to help you meet your borrowing needs. |

| What is your solution? | We provide loans based on the equity of a vehicle and our liberal credit policies. |

| Target Market | Car owners |

| How will you make money? | Percent by credits |

| Tell us about the market & founders, why is this a great opportunity? | Finova technology is the key to greater financial inclusion. Finova’s online Car Equity Line of Credit(C-LOC) costs 50% less than the national average. We better assess the creditworthiness of our clients and approve more loans than most other lending companies. We know life has emergencies and with Finova you accrue Finova Points with each timely payment. If you need to move your payment to a later date, you can do so by using your saved Finova Points. We care about your financial, physical, and psychological health. You can borrow money from Finova with a minimum 12-month repayment term. Most lenders offer only short-term loans, Finova loans provide a minimum 12 month pathway back to financial health. This is why we are good for: (1) smart, emergency loans; (2) an option to consolidate other loans; or (3) others seeking fast affordable loans. Greg Keough, Founder, CEO at Mobile Financial Services – A MasterCard and Telefonica International Joint Venture |

| Founders Names | Derek Acree, Greg Keough |

| Founders Email | NA |

| What type of funding has the company received? | Angel |

| If you have a press kit or image gallery please provide a link (optional) | NA |

| Website | www.finovafinancial.com |

| Twitter Handle | FinovaFinancial |

[lc-response-form id=1]

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job