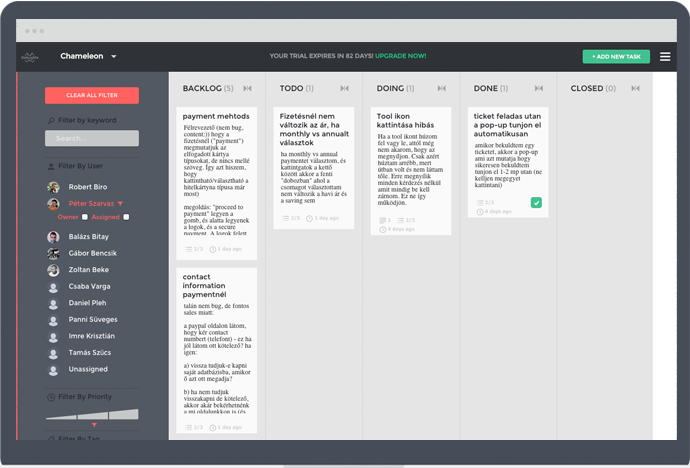

Ed: Very easy way to discuss problems or changes with developers, looks simpler than Invision. Startup Name...

Mike88

Mike Nicholls Australian Inventor + Entrepreneur working with a small team of engineers building prototypes from Inventions including two medical devices. Publishes Startup88.com and has assessed/reviewed +500 inventions and +200 startups in the last 3 years. Mentors Sydney Startups via Incubate and other incubators and helps members of the Australian Startup Community via the Startup88.com website with free publicity and advertising. Experience in numerous industries including Digital Publishing, Cloud Computing, Apps, Hardware, Aviation, Real Estate & Finance and Health/Medical Devices.

Too often I hear or receive pitches from entrepreneurs that waffle on endlessly without actually saying anything....

Ed: Terrible pitch but the app looks interesting, website does a much better job of explaining. Wonder...

Following on from yesterdays topic of knowing your startup’s Runway raises the topic of how long it takes...

Ed: More Developer focused Microservices. This is a bit of a pain, trying to setup mail servers...

The one thing every startup has to know and share with their investors and possibly their team...

Ed: Its seems like a good idea and I’m sure it would be a good service for...

Ed: Nice app, as you can see it did the Startup88 site in simplified Chinese. It’s a good...