Uber App

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

Some business laws are like gravity – one of those is The Law Of Effective Marketing.

This Law states: Effective Marketing = Customer Growth while lifetime value of customer < cost per customer acquisition.

Right now there are many business models – Apps or platforms of some kind – where this law is being violated and some startup Founders are being rewarded.

As digital marketers and startups weigh up the funds they have at their disposal lifetime customer value and customer acquisition costs a strange anti-gravity effect can be observed – inefficient growth is encouraged.

This is growth where you are paying more each time to get your next customer or service an existing one.

Just like the law of gravity the law of effective marketing always works. But lets explore how this plays out in our day and age.

A start up or possibly two will make the case that they can ‘disrupt’ a market – usually via a platform or app of some kind.

After working out ways via Google or Facebook to reliably get customers. They start looking for capital. Finding the traffic, working out what works, hiring people to think – it’s expensive – and a few startups take on funds to continue their growth within a vertical.

A few more ventures start in the same space and they are now also bidding on search terms and digital conversion funnels to generate customers. Prices rise. More capital is raised. Competition ensues.

Now a bunch of startups all aiming at the same space with similar proposition are all trying to out-raise and out-spend each other on customer acquisition.

When you do this you force your competitors to burn through their capital faster than they anticipated and return to their investors without having hit targets on runway time-line or acquisition costs.

Nevertheless the case of the global addressable market is now made. Investors can smell blood in the water and tip more money in. The result: bigger investment rounds and more of that is pocketed by Google and Facebook.

(No wonder they themselves are keen investors the money they put in is like a boomerang)

All this while prices for advertising and customer acquisition go up and up.

At some stage some of the ventures begin to sputter. Their investors lose the ability to easily compete for funds in an ageing space where the half life of the market is weeks not years – some fold, some look for niches to “own” and some try and make themselves acquisition targets.

Normally at this stage usually one or two ventures remain at the top of the pile. Usually those with the biggest war-chests Uber and Lyft come to mind for car sharing space.

At the bottom of the pile of “also runs” searching for niches, paying more for their next customer and going through their last gasps are the likes of every other car sharing business that hasn’t raised $8bn in funding in 4 years. Often they (and their investors) don’t even realise these are their last gasps.

Businesses like Australian in taxi App Ingogo, or car sharing models Car Next Door, Carhood, Go Get might find their niche, be acquired, or somehow return their investors funds, but they can’t win the war.

But it’s just as likely they won’t exist in a couple of years because soon the law of gravity will take effect again for the big couple of remaining players and they will be paying next to nothing to acquires customers or service their existing ones.

These large players in effect, just raised the marketing ineffectiveness to such an extent that like Icarus’s a number of businesses flew too high and must come down.

The few big spenders have bought the market-share, first of mind dominance needed for the global addressable market. Now their costs per customer acquisition are going to plummet.

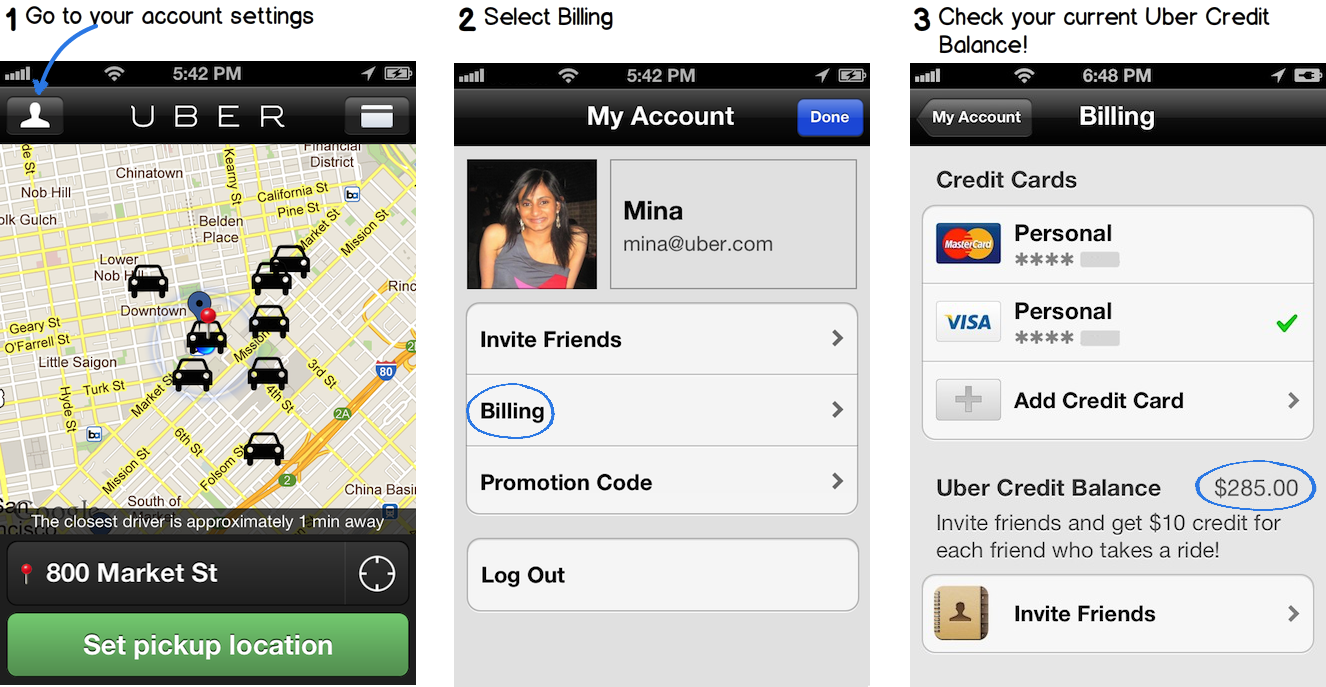

They possibly will withdraw some of the incentives they self impose like “share with friends and both get credit” because now all their friends already know. Why should they take $50 off their earnings?

The dominant remaining platforms do not have to advertise any more. Instead they spend their time working out how to comply with The Law Of Effective Marketing.

Conclusion

Clearly there are winners in these Icarus-like pursuits but more often than not there are losers.

If you are not the best-funded or best located for funding (ie Silicon Valley) you must not get sucked up in the violation of The Law Of Effective Marketing.

You must instead look for ways to grow at less cost per customer. Perhaps this way you will occupy a niche or be worthy of acquisition. Maybe you can even get your marketing to be cashflow positive (that would be nice).

Perhaps you’ll create a merchandise, product sample or way of getting a profit-leader instead of a loss-leader.

Do this and you might have a business.

Photo by TheTruthAbout

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job