Pocketbook Web App

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

I met Bosco Tan at Peter Coopers Sydstart last year. At the time he looked like he was in for a long hard road to get users to give up access to their bank accounts and to get any support from the banks.

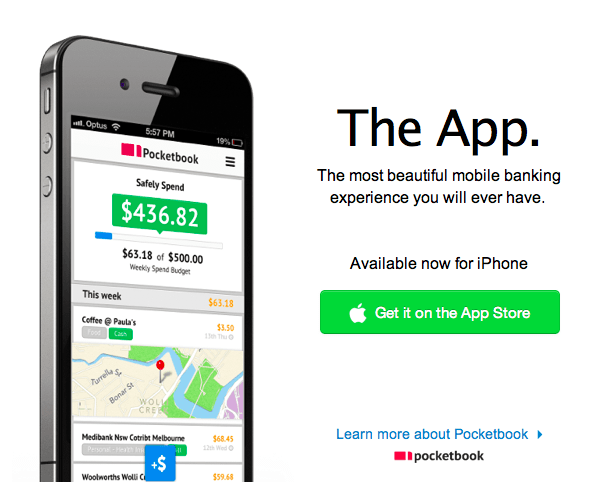

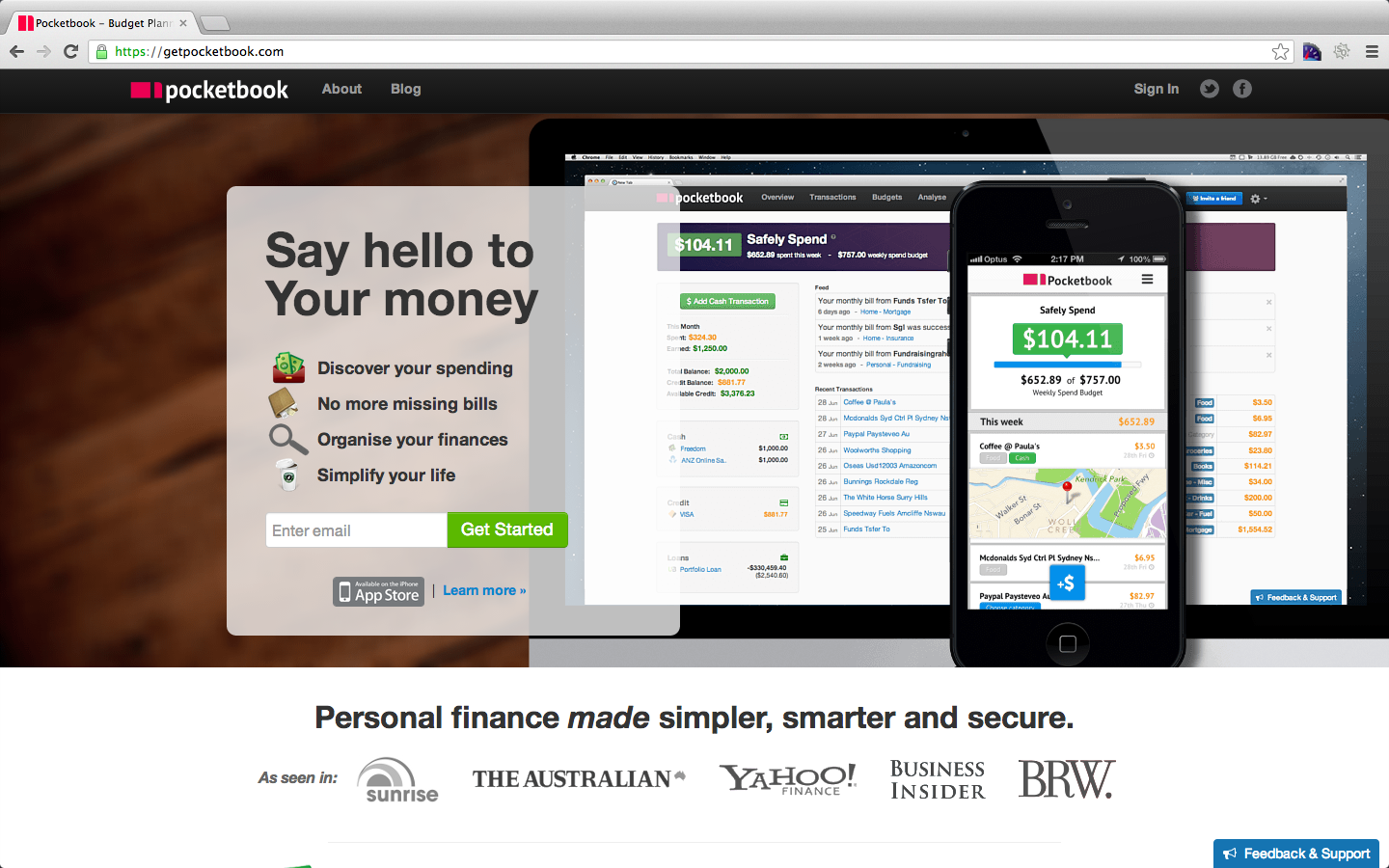

Well persistence pays, because it looks like they are really getting some traction. The Pocketbook web and Iphone app is Australia’s equivalent of Mint.com (which doesn’t work outside the USA), it allows you to sync all of your different bank accounts, credit cards and then automagically reviews your transactions and automatically catergorises most of them and tracks recurring bills and payments and puts these into a budget and bill schedule so you get a reminder when it due.

Pocketbook gives you one view of all of your accounts which is pretty handy.

I found the whole signup routine very slick, it was clear a lot of User Interface effort has been put into ensuring users could get logged in and their accounts setup very quickly.

What been the hardest thing?

What surprised you?

Can you tell us how many users or at least a growth factor?

Have you got any good startup war stories?

Are you at the point where you need to think about scaling and architecture issues?

What mistakes have you made?

We don’t feel like we’ve made many big mistakes to date. It’s been pretty smooth.

We debate a lot – pros and cons about features, what platforms to be on, which banks to support etc. We let our users guide us a lot of the time. We get about 50-80 bits of email on a daily basis with great feedback and suggestions, we created a voting page for banks our users want added – https://getpocketbook.com/

What have you really done well?

We think we’ve done well to capture usability. Alvin and I are pretty average consumers – we hate having to do accounting and we both value our spare time – these things we suspect are pretty universal for most Australians. With this, we designed the product for people just like us. The web interface is for quick planning on the couch or the kitchen table, and the mobile app is for on the run – those couple of minutes at the supermarket or that morning train ride to work.

What we found was that most current personal finance products out there fall into two camps – they’re either for the sophisticated amateur accountant, or they require too much manual entry. So we set out to be different, if you know how to check your friend’s status updates on Facebook or if you know how to check your balance on internet banking, you should be able to budget with Pocketbook.

Whats your next big milestones?

We got a few exciting things coming up. From a product perspective, we just launched our mobile app on iPhone to an amazing response . We’re working on the next big request – an app for Android. It’s tax season, and we’re working on something to simply the process of doing tax returns – in fact, that’s where the product originated. Some info here – https://getpocketbook.com/

Aside from product, we’re closing our round of funding so we can move even faster. We’re also competing in the finals of the SWIFT Innotribe 2013 Startup Competition in Dubai this September. SWIFT is a financial messaging cooperative between 15,000+ banks globally. Think “SWIFT Code” whenever you transfer money overseas. So this is recognition at the highest level in our sector. Of the 9 companies competing, we are one of 3 representing Asia-Pac and the only company from Australia. You can read more here: http://innotribe.com/

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job