InvoiceAgent.ai - AI-powered invoice automation that extracts, organizes, and analyzes invoices in minutes—saving SMEs time, money, and...

Pitch your Startup

ThriveDesk - AI Agent for Delightful Customer Service

Starscape SEO - SEO and Web Services in Kitchener-Waterloo-Cambridge

StreetSmart - The background check for your next apartment

Reachingly - Reachingly helps B2B teams find leads, warm up inboxes, and send high-converting cold email campaigns...

VoidMagic AI - AI Voice Clone

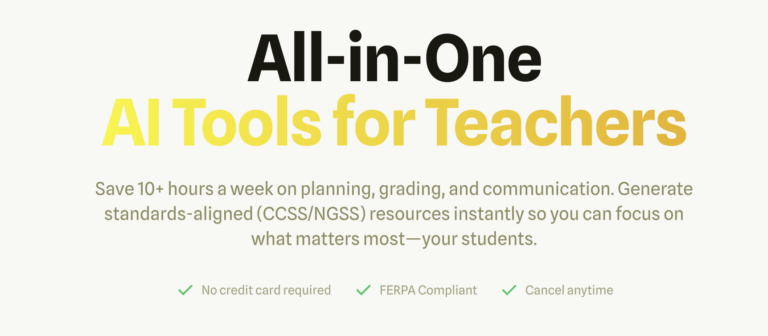

TeachQuill - The #1 All-in-One AI Platform for American Educators.

Pixmind - PixMind is an AI-powered visual creation platform designed to help users generate high-quality images and...