Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

After our post last night regarding Crowdfunding & The Submission of the CAMAC report on Crowdfunding Regulations, Paul Niederer, CEO of ASSOB wanted to throw some weight behind the discussion. He clearly outlines the actual legislative changes need to allow Equity Crowdfunding to operate in a meaningful way.

Most people haven’t heard of Crowdfunding let alone equity crowdfunding. What that means is that if regulatory change is required there isnt a lot of domain knowledge about to ensure that what gets implemented is practical and workable. Witness the U.S.A. The path taken is legislative change, then regulatory change then industry implementation.

Already most participants are saying what has resulted is unworkable.

The United Kingdom has taken a more measured approach. The regulators worked with industry participants like Crowdcube and Seedrs to test and refine methods so that eventual changes have been road tested.

Australian regulators are waiting on the outcome of CAMAC’s study of submissions and other countries findings before making a move in the equity crowdfunding space. Hopefully this wont mean a U.S. style implementation.

Legislation, then regulation, then implementation with feedback cycles from industry then updated legislation and regulations.

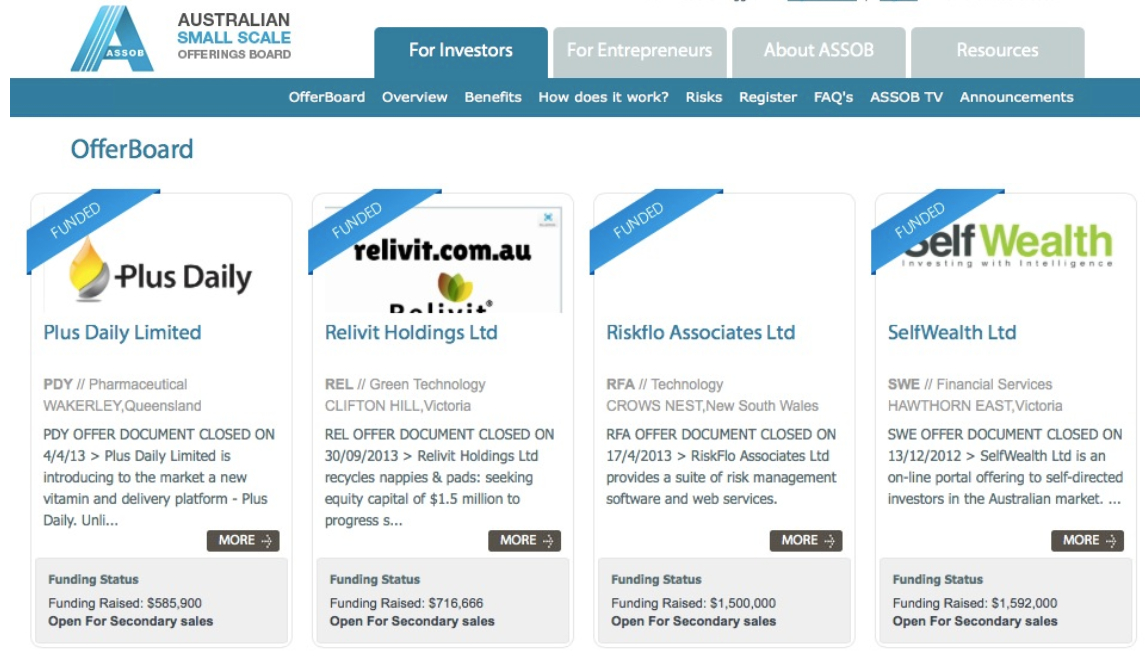

There is an easier path because Australia has 20 odd years of experience in managing investment from retail investors which has spawned ASSOB the oldest and longest running equity crowdfunding platform in the world.

Eight years, 300 Startup / Early stage raises and $138 million later we believe there is an easier path than the path most countries are taking.

At the end of the day most equity crowdfunding is about legitimising transactions that take place from money invested into the early stage space that comes from friends, family, fans and followers. High net worth investors are already covered by adequate legislation.

A recent article in Forbes stated “For the vast majority of people, money is raised from banks, from personal savings, and from family and friends.” The task of equity crowdfunding regulations is to properly legitimise this.

This is not a new area for Australian regulators as small scale offerings legislation has operated in this space for a long time.

So what is the suggested pathway forward?

Australian regulators are able to modify the fundraising provisions of the Act for ‘minor and technical relief’ without the need of a full parliamentary enquiry or indeed a report from CAMAC or any other government body.

Like the U.K. regulators they can sit down with industry participants and see what would work in practice.

Here are some of the changes that would enable Australia to embrace two huge trends that are driving crowdfunding. Technological Disruption and Meaningful Investing. For a more detailed discussion visit here.

- A new category of Equity Funding Portal be established for “Crowd Sourced Equity Funding” CSEF. Maximum $1 million per company per annum with a $2,500 max per investor.

- Small Scale Offerings 20 retail investors in a twelve month period should be lifted to 100 but there should be a cap of $25,000 per investor per annum. A maximum of $2 million can be raised per annum including the “CSEF” exclusion.

- Broaden the definition of Associates. This group is not fully handled sufficiently in existing legislation.

- Add category of “Experienced” investors. These could be for example people that have reached a certain level in Angel and Director organisations

- Recognise that consultants can accept shares for services rendered but cannot invest funds. This will assist cash-strapped companies in obtaining the corporate advice they need, without burdening operational cashflow requirements.

- Portals cannot give advice or have a pecuniary interest but can curate offerings.

- Registered Portals can disclose summaries of the offer information to the public but prospective investors need to log in to see full deal details. Promotions must follow rules as per small scale offerings regulations.

A graphic that summarises this is as follows:

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job