After over three years in regulatory limbo, the Securities and Exchange Commission (SEC) has finally voted the...

Crowdfunding

Ian Maxwell has a slightly tongue in cheek proposal for Crowdfunding originally published on his blog. In...

Three months after the submission of the CAMAC Crowdfunding Legislation recommendations we are expecting further delays of 12 – 18 months...

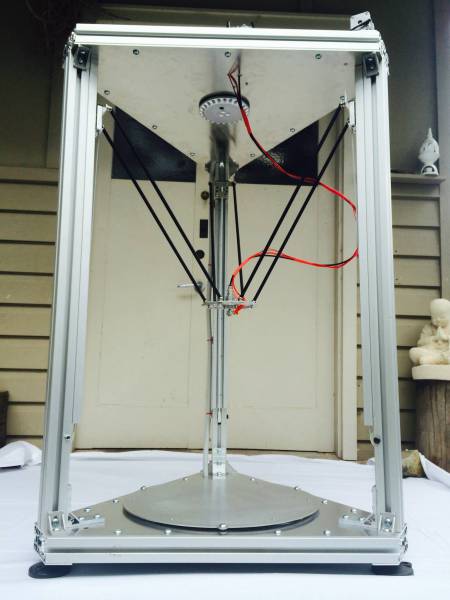

Meet the Metaltree 3D Printer maker Jason Crowe. At 1.2m high this is the biggest 3D printer...

This weeks Nailing It goes to Dominic Green. I first met him through my brother (David) some...

While Crowdfunding gets most of its publicity due to massive campaigns for sexy devices on Kickstarter our...

Paul Niederer CEO of ASSOB, Australia’s longest running and most successful Crowdsourcing platform shares the best in...

A few weeks ago CAMAC released the Crowd Sourced Equity Funding Report May 2014. (right before being axed in...