Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

The development of a Crowd Sourced Equity Funding Marketplace will come down to how you and other participants and the regulators view it, you could see CSEF as an Asset Class, Marketplace or Punt.

Word on the street is that Equity Crowdfunding legislation will be introduced to parliament in the Spring Session (September – November) and not as first thought in the June July Session.

This has set tongues wagging in the scene as Platforms (aka Intermediaries) ponder the shape this legislation will take and how it will affect them in connecting Issuers and Investors.

There seems to be irreconcilable differences between those who believe that the Intermediaries role should be minimal and those who believe the Intermediaries can not only enforce regulations but offer increased value by qualitatively assessing early stage companies.

Market enthusiasts want to reduce friction in the marketplace by placing the responsibility for what Issuers provide to Investors solely with the Issuers and believe Investors should be responsible with and for their own investments.

At the other end of the spectrum, there are market commentators suggesting that Investors in CSEF be required to complete a short course provided by Registered Training Organisations before being able to invest. ED: What a joke the nanny state has become, but sadly you could imagine this actually happening.

This would be an extra requirement levied on CSEF investing that is not applicable to any other equity class and the market enthusiasts find this sort of idea repulsive.

Clearly not everyone will be happy with what the framework is when it does get introduced.

You might think after reading the above that nothing therefore very interesting was happening in the Australian CSEF scene.

Well that’s not correct.

One of the interesting things that has evolved through not having specific legislation is the spectrum of ways in which Intermediaries are making it possible for Investors and Issuers to engage in Crowd Sourced Equity Funding.

Platforms have adopted and adapted to meet areas they think will be fertile even in the absence of CSEF legislation.

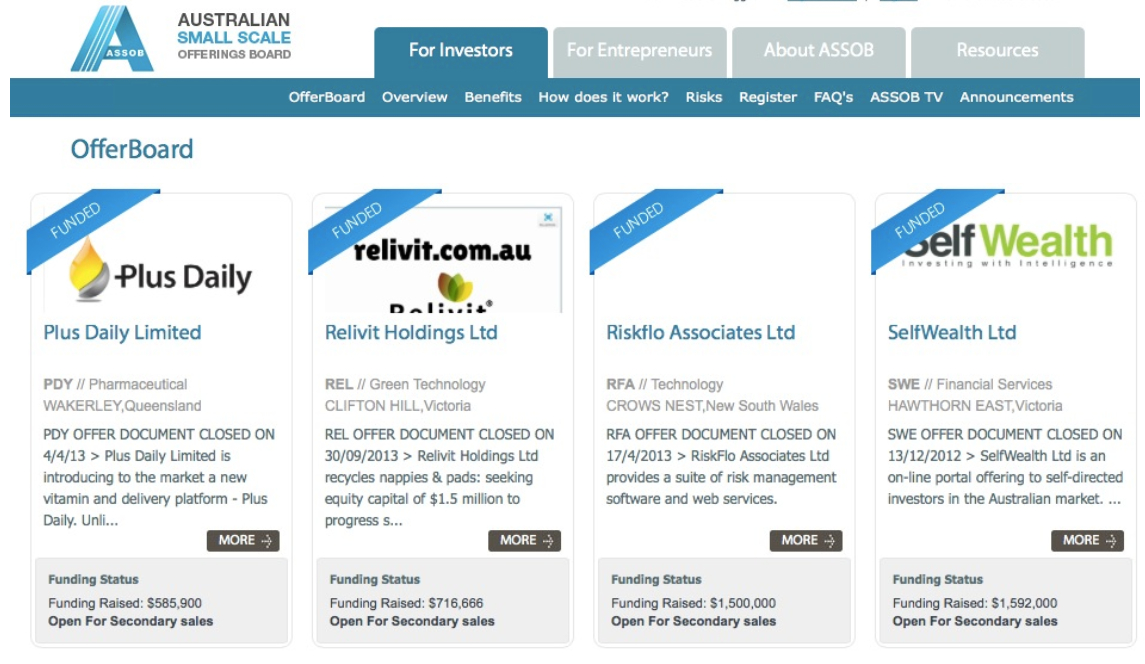

Offer Boards

The Australian Small Scale Offer Board was established 12 years ago and has seen funding of $140m go to over 200 companies in this time. This platform has operated according to an exemption in the Corporations Act that allows business matching services. Recently CrowdFundUp and TMEffect have launched platforms operating within the same exemption as ASSOB.

Deal Types

CrowdFundUp differentiate themselves by having a focus on Real Estate Crowdfunding.

Real Estate Crowdfunding has proven to have commercial traction overseas and so with the appetite for real estate investing in Australia this platform may find itself well positioned.

Small Raises

Lite Raise – The Capital Exchange and ASSOB have teamed up to produce a DIY set of workbooks, guidelines, courses and of course the legal framework that would allow anyone to handle and manage a raise of upto $100,000. The cost is $495 and is backed by a 60-day guarantee and returns policy.

This strategy clearly looks to a minimal role of the Platform and puts the responsibility for what is presented onto the person looking to raise funds to present compelling and accurate information.

The Lite Raise is aimed at competent, time-rich, cash poor entrepreneurs.

Neighbourly Support Bro

This week saw Equitise commence trading on its platform (based in NZ). Investors can invest from Australia but Issuers must be incorporated in New Zealand.

Much like an Offer Board the deals are assisted, particularly at this early stage of the platforms life, with preparing the Issuer for making compliant statements to regulators and compelling statements to Investors.

New Zealand has placed a lot of responsibility on Platforms to conduct due diligence through a licensing regime of the Platforms. The “headstart” Equitise (an Aussie company at heart) has should bode well for its future when legislation for CSEF goes ahead in Australia as it is likely to be modelled in part on the New Zealand framework.

Within the NZ framework the role of the Platform is to make sure market players like the Issuer (business trying to raise funds) is compliant.

Equitise has no stake in the first company listing on their platform however New Zealand regulation allows them to take shares in Issues on their platform so long as this information is disclosed to Investors.

Equitise is hoping to be the CSEF destination for the majority of the market

www.Equitise.co.nz and www.Equitise.com.au

The New VC Model

FatHen

FatHen has a model operating under a completely different system. They have an Unlisted Public company which attracts money from retail investors and puts it directly into hand-picked deals. This model is called Crowd Backed Venture Capital.

Retail investors can invest as little as $100 and get a stake (albeit indirectly in crowd funded businesses). Issuers on the other hand must meet stricter requirements and are reporting back to FatHen instead of the individuals in the crowd. FatHen takes care of all the compliance and administration, due diligence and legal work on behalf of Investors.

Investors can direct their investment to a single company or opportunity listed by FatHen or the FatHen portfolio of companies.

This value proposition aims squarely at the cash-rich, time-poor profossionals who would likely look to diversify their portfolio by becoming investors in CSEF.

The Rabbit Hole

The degree of thinking and engagement in CSEF already out there is really exciting. However, this could be just the tip of the iceberg.

There are other players in the market who are yet to show there cards. Venture Crowd for one has access to great deal flow and may move their offering in time from Sophisticated Investors only to Retail Investors.

Pozible may bring with them a game changing database of successful crowdfunders from the rewards space that the other platforms are only just starting to cultivate.

Industry specific, regional or self-hosted formats of CSEF may also emerge. One thing that is sure to emerge is plenty of options for Investors and more options for Australian Entrepreneurs and that has to be a good thing.

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job