qplum

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job

| Startup Name | qplum |

|---|---|

| What problem are you solving? | Anyone who has felt the lack of access to good processes and systems when investing will find our service useful. Retail investors have 3 choices right now – Do nothing, give the money to someone else to manage for them or learn all the technical jargon themselves. We offer the 4th alternative where people who are looking for a systematic, quantitative approach to investing, will find all the tools they need along with all the \’behind-the-scenes\’ implementation already in place for them to use simply through our platform. |

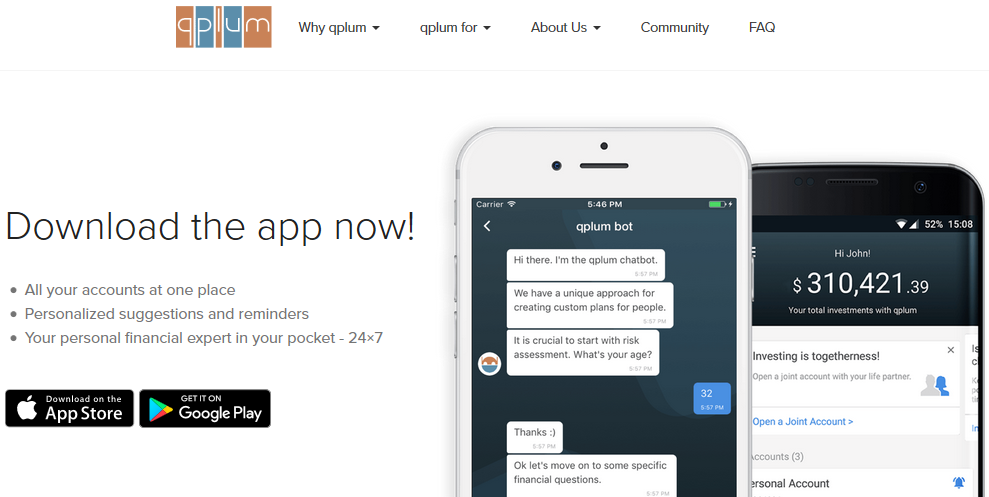

| What is your solution? | qplum is a service that puts you in control of your investments, where we believe smart investing is a mix of strategies rather than product choices. Using quantitative methods and technology, fearless investing is possible. We are a quantitative research firm offering all our trading strategies to asset managers via APIs. We are also a robo-advisor in ETFs and futures. |

| Target Market | Consumers |

| How will you make money? | Sign-up on website is free. Flat fee as a % of AUM when investing in a portfolio. |

| Tell us about the market & founders, why is this a great opportunity? | Mansi Singhal has over 10 years of experience in portfolio management and her last job was at a $30bln hedge fund, where she was managing a $100mm portfolio for them. Prior to that she was a trader at several big banks like in Bank of America, Merrill Lynch, Wachovia Bank. She completed Masters in Computer Science from University of Pennsylvania, and currently holds Series 65 and Series 3 certifications.Gaurav Chakravorty, the co-founder, is one of the early pioneers in high-frequency trading. He built the most profitable algorithmic trading group at Tower Research from 2005-2010 and was the youngest partner in the firm. The strategies developed by Gaurav and their offshoots have made more than a billion dollars of profits over the last ten years. Gaurav is also a co-founder of DV Capital, that currently trades over 20 markets across the world using algorithmic systems. Gaurav has been one of the most successful fintech-datascientists in last ten years. Mansi and Gaurav feel that great investment management is about building systems to do a lot of things well. There is no silver bullet. That\’s why we are working on execution, trading infrastructure, data science infrastructure, alpha strategies, tax allocation methods, macroeconomic forecasting among others. |

| Founders Names | Mansi Singhal |

| Founders Email | NA |

| What type of funding has the company received? | NA |

| If you have a press kit or image gallery please provide a link (optional) | NA |

| Website | www.qplum.co |

| Twitter Handle | @qplum_team |

[lc-response-form id=1]

Pitch your Startup, App or Hardware or post a Startup Event or Startup Job