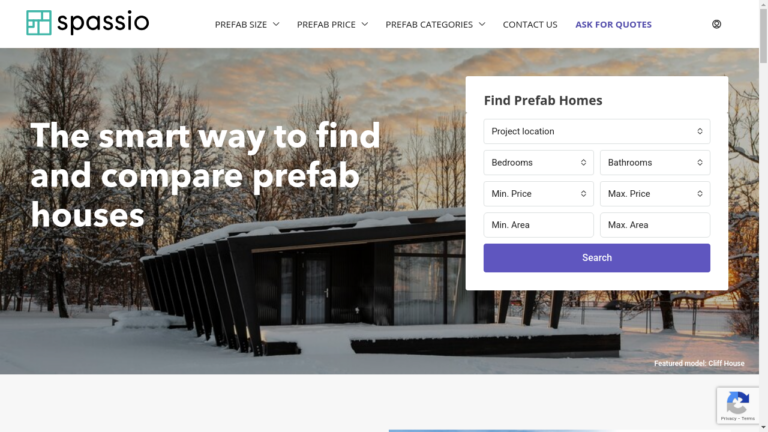

Startup Name: Spassio Tagline: passio: Your one-stop shop for prefab homes in Europe. Compare models, find manufacturers,...

Real estate

While Crowdfunding gets most of its publicity due to massive campaigns for sexy devices on Kickstarter our...

By David Drake GroundFloor, a peer-to-peer real estate lending platform, is launching a landmark securities offering that...

New York, April 22, 2014 (GLOBE NEWSWIRE) — It’s a #CrowdFundRealty day this Thursday, April 24, in New...