While Crowdfunding gets most of its publicity due to massive campaigns for sexy devices on Kickstarter our...

New York City

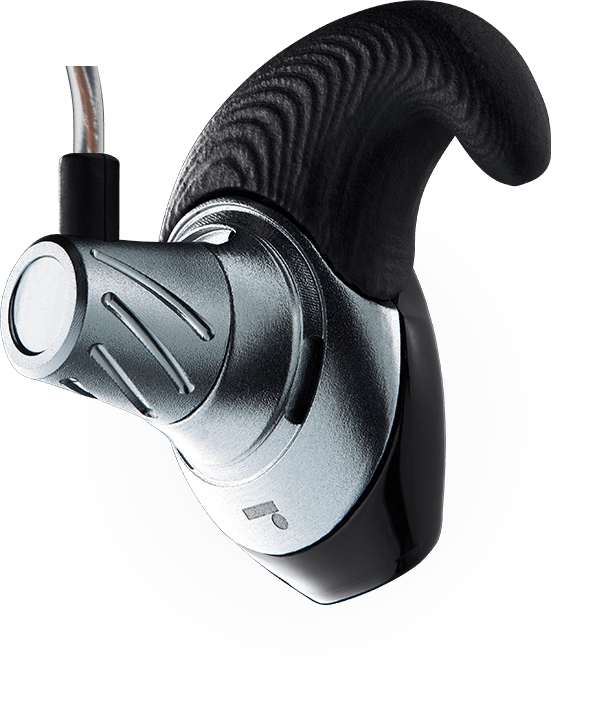

These are cool, custom made 3D printed earphones for similar (albeit expensive) pricing to premium ear buds....

By David Drake GroundFloor, a peer-to-peer real estate lending platform, is launching a landmark securities offering that...

by David Drake Regulation A+, which is also known as Direct Public Offering, will significantly bring down...