Andy Tompkins and Bryan Vadas are the founders of the iPledg.com Crowdfunding platform. iPledg is serious about helping the Tech and Startup...

Crowdfunding

Look at Scrubs star Zach Braff who, after appealing to his fans to support his indie film...

Paul Niederer is the CEO of the Australian Small Scale Offerings Board (ASSOB), Australia’s largest and most successful...

Storify by Mike Nicholls Sat, Nov 16 2013 17:31:03 Crowdfunding Articles Interesting collection of recent Crowdfunding Articles...

Getting through college is tough and even more so in a recession. The Consumer Financial Protection Board...

Sydney based Dave Jones the editor of Electronics Engineering Video Blog http://www.eevblog.com/ has an awesome crowdfunded project on Australia’s...

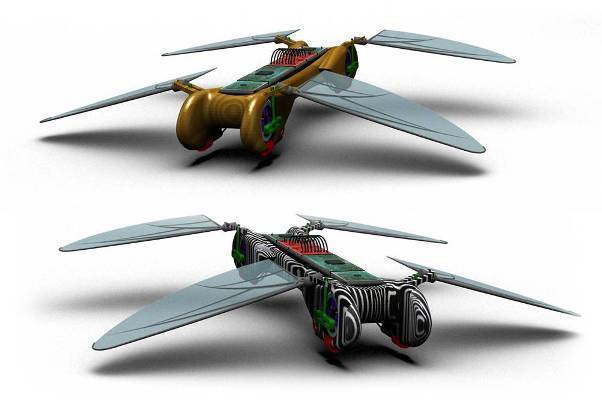

Arguably Mosquitos have had the greatest negative effect on human life of anything in the world,...