Ian A. Maxwell is a veteran Technology Entrepreneur and Venture Capitalist. He is currently CEO of BT...

Venture capital

Rick Baker is the Managing Director of Blackbird Ventures, a Sydney based Venture Capital fund raised early...

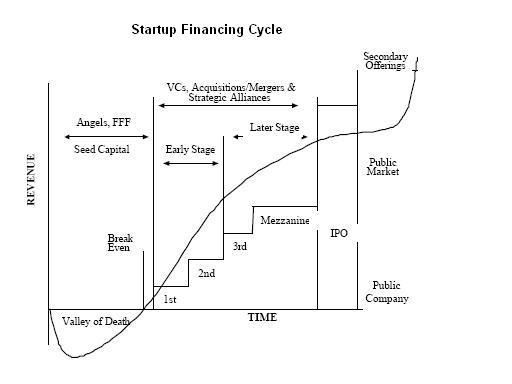

In Australia too often Angel Investors have to play the role of a Venture Capitalist for technology...

Ian A. Maxwell is a veteran Technology Entrepreneur and Venture Capitalist. He is currently CEO of BT...

This is the first article in a series of articles from entrepreneurs that have been through Incubate, the...

I attended a presentation by Venture Capitalist Bill Tai of Charles River Ventures last week, (apparently the largest...

Many people don’t think its possible to get a customer to fund your business, but it really...

Learnable the programming focused MOOC has launched their election campaign with a bang doing what no...