Startup Name Mometic What problem are you solving? There is no other way to quickly identify which...

Mike88

Mike Nicholls Australian Inventor + Entrepreneur working with a small team of engineers building prototypes from Inventions including two medical devices. Publishes Startup88.com and has assessed/reviewed +500 inventions and +200 startups in the last 3 years. Mentors Sydney Startups via Incubate and other incubators and helps members of the Australian Startup Community via the Startup88.com website with free publicity and advertising. Experience in numerous industries including Digital Publishing, Cloud Computing, Apps, Hardware, Aviation, Real Estate & Finance and Health/Medical Devices.

Ed: This looks very interesting but the pitch was a little different to the website when I...

Ed: I implemented my first CRM about 15 years ago, at the time ACT was a very...

Ed: Back when I was a young naive newbie entrepreneur who had no clue about Trademarks and...

Ed: What a great idea, crowdfunding via supply of skills. Job Title Marketing Expert Startup Name Spark...

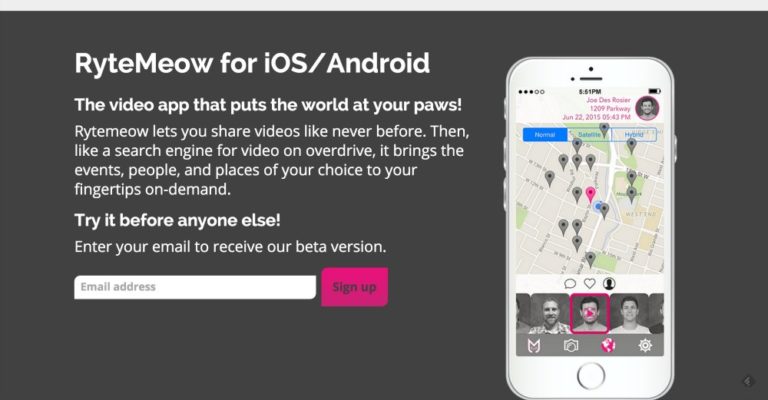

Ed: I wonder if the horse has bolted on the video space, the three big Western players...

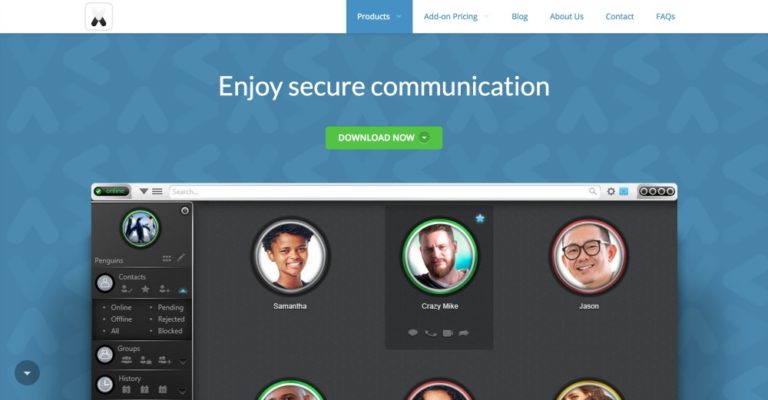

Regular readers will recall, I am keen for solutions which offer private citizens the option to protect...

Great idea, having built a few businesses and platforms, some moderately successful others total flameouts, I can...